GST in Malaysia - One Year On Following numerous delays and postponements since its initial announcement back in 2009 the goods and services tax GST regime was implemented in Malaysia on 1. The MSIC 2008 version 10 is an update of industry classification developed based on the International Standard of Industrial Classification of All Economic Activities ISIC Revision 4.

Sample Of Gst Reporting Evilog Consulting

CHARTERED TAX INSTITUTE OF MALAYSIA 225750-T Page 1 of 5 Unit B-13-1 Block B Unit 1-5 13th Floor Megan Avenue II No12 Jalan Yap Kwan Seng 50450 Kuala Lumpur Tel.

. The RM39 billion collection will constitute 31 of Malaysias gross domestic product GDP according to the Economic Report 201516. The tax codes in italics are MYOB default tax codes and are not applicable to Malaysian GST. Ad Automate tariff code classification for shipping to 180 countries.

Your Bullsh T Free Guide To New Zealand Tax For Working Holidaymakers. Thursday 8 December 2016. GST tax codes for purchases and supplies.

The tax codes list window displays all the GST codes available in MYOB. Purchase of fixed assets with. Standard-rated supplies under Margin Scheme.

GST Tax Codes for Purchases. The article was first published on february 16 2016 and has been updated on january 2 2020. GST Malaysia - Tax Code for Purchase PURCHASE Tax Type.

Government Securities Daily Trading Information. Our main office is located in Klang Selangor Malaysia. Export of goods from Malaysia to Designated Areas - Customs Form No.

New tax codes introduced in August 2016 Purchases Sales Goods Services Tax Malaysia Is your business liable for GST. AESOFT TECHNOLOGY SOLUTIONS - GST Tax Code for Malaysia 18 Aug 2016 Selangor Malaysia Kuala Lumpur KL Klang Supplier Suppliers Supply Supplies AESOFT TECHNOLOGY SOLUTIONS is a company that specializes in PC laptop rental services and supplies POS peripherals. GST Tax Codes Malaysia.

GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. Personal reliefs for resident individuals Types of relief YA 2016 RM Self 9000 Disabled individual - additional relief for self 6000 Spouse 4000 Disabled spouse - additional spouse relief 3500 Child per child below 18 years old 2000. Ks Chia Tax Accounting Blog Recommended Gst Tax Codes.

GST code Description Rate GST-03 fields. GST TAX CODES - Malaysia. Special Edition Finance Bill 2016 A snappy delight Greetings from Deloitte Malaysia Tax Services The Prime Minister and Minister of Finance YAB.

New GST tax codes introduced in August 2016. Malaysia September 30 2016 The inaugural National GST Conference 2016 jointly organized by the Royal Malaysian Customs Department Customs and the Chartered Tax Institute of Malaysia was held. Goods And Services Tax Malaysia TX.

All the information and recommendation as prescribed in this guide such as tax code for purchase supply mapping of GST tax codes with GST-03 return and GST reports in form of GAF will ensure better GST compliance for. Revenue from the Goods and Services Tax GST which was implemented last April is projected to increase to RM39 billion in 2016 from RM27 billion this year. Najib Tun Razak unveiled the Budget 2017 on 21 October 2016.

Purchases with GST incurred at 6 and directly attributable to taxable supplies. Gst2016-01-14 - Bank Negara Malaysia. Ks Chia Tax Accounting Blog Recommended Gst Tax Codes.

As a follow-up to the Budget 2017 Speech the Finance Bill 2016 was released on 26 October 2016. Goods And Services Tax Malaysia TX. The two reduced SST rates are 6 and 5.

This guide also provides guidance to GST registrant that used any accounting software for their businesses. Malaysia implemented the goods and services tax gst regime from april 1. Prime MinisterFinance Minister of Malaysia invited Conference Date.

Quickbooks Malaysia Solarsys Page 10. A GST registered supplier must charge and account GST at 6 for all sales of goods and services made in Malaysia unless the supply qualifies for zero-rating exemption or falls outside the scope of the proposed GST model. New tax codes introduced in august 2016.

Latest version of malaysia gst advance for sage 300 erp version 2014 2016. Preparing your business for GST Changes to GST 2018 GST zero rated Setting GST to 0 in Sage 300 Sage 300 checklist for GST at 0 GST vs SST Sales Services Tax 2018 Setting up for SST in Sage 300 Create new Tax Authority for SST. The GST collected from customer is called output tax.

NATIONAL GST2016 CONFERENCE DAY 1 TUESDAY 31 MAY 2016. Increased to 28 wef YA 2016 25 for YA 2015. The Goods and Services Tax GST is an abolished value-added tax in Malaysia.

Avalara automates tariff code classification to help you stay compliant with less effort. Thursday 8 December 2016. Berjaya Times Square Hotel Kuala Lumpur ENSURING FISCAL SUSTAINABILITY WITH GST.

The standard goods and services tax GST in Malaysia is sales and service tax SST of 10. GST Malaysia - Tax Code for Purchase PURCHASE Tax Type. Purchases with GST incurred at 6 and directly attributable to taxable supplies.

GST is on margin only. 6a 6b and 16. 31 May 1 June 2016 Conference Venue.

Here is a list of tax codes that are available in MYOB Accounting v24 and MYOB Premier v19 Note. 406000 companies have registered for GST as at March 2016 GST collection for 2015 is estimated to exceed the target of RM 27 billion total. TAX CODE 1 Government Tax Code There are 23 tax codes in GST Malaysia and categories as below.

Purchase of fixed assets with GST. GST code Rate. GST code Rate Description.

On 7 March 2016 the Yang di-Pertuan Agong Abdul Halim congratulated the. Goods And Services Tax Malaysia IM. 40 Tax Code Update In The Latest Guideline From Royal Malaysian Customs Department 20 July 2016 Youtube.

The Malaysia Standard Industrial Classification MSIC search engine system or e-MISC was developed to facilitate the users to find the relevant industrial code. Goods Services Tax 0. The year of assessment YA is the year coinciding with the calendar year for example the YA 2016 is the year ending 31 December 2016.

When recording transactions for GST reporting these are the codes that is used. Standard-rated supplies with GST charged. The basis period for a company co- operative or trust body is normally the financial year ending in that particular YA.

New tax codes introduced in August 2016. Explanation of Government Tax Codes For Purchases Explanation of Government Tax Codes For Supply Previous Post Next Post. The first reduced SST rate 6 applies to restaurants hotels and accommodation car hire rental and repair domestic flights insurance credit cards legal and accounting business consulting electricity.

Goods Services Tax GST at 0 from June 1 2018 GST tax compliance updates in MYOBABSS. GST Tax Codes for Purchases GST Tax Codes for Supplies With the GST compliant versions of MYOB Accounting v20 and Premier v15 these tax codes have already been setup for you If you are using an older version of MYOB please see Accounting for. NATIONAL GST2016 CONFERENCE Programme Outline 850am Overview of Day 1 Ms.

It applies to most goods and services.

Pdf Goods And Services Tax Gst In Malaysia Behind Successful Experiences

Gst High Resolution Stock Photography And Images Alamy

How Do I Set Up Sales Gst Vat Rates And Use Them O

Repairing My Macbook Pro Macbook Pro Repair Lettering

Asia Pacific International Entrepreneur Excellence Award 2016 Excellence Award Web Based Online Acco Excellence Award Online Accounting Software Achievement

Poney East Coast Mall Relocation Clearance In Malaysia East Coast Relocation Coast

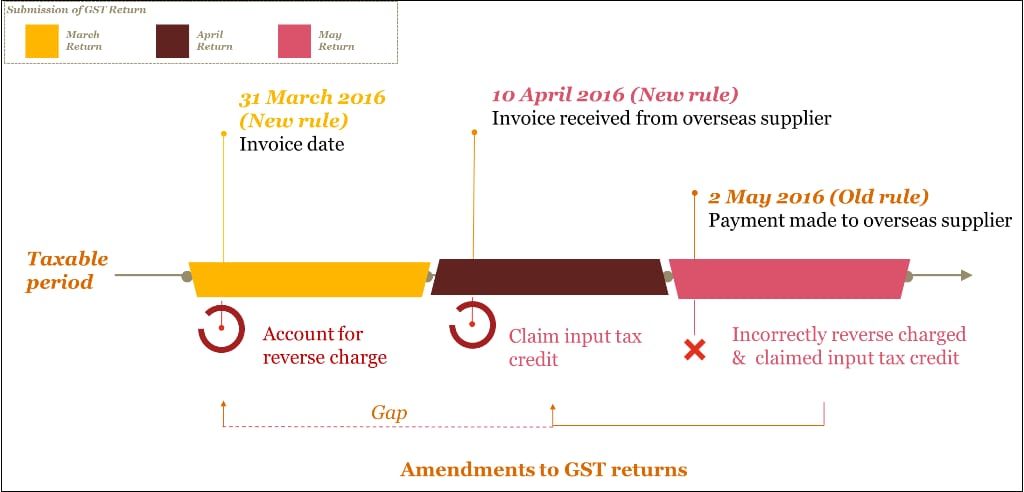

Think You Know All About Reverse Charge

Pdf Public Acceptance And Compliance On Goods And Services Tax Gst Implementation A Case Study Of Malaysia

Customer Tax Ids Stripe Documentation

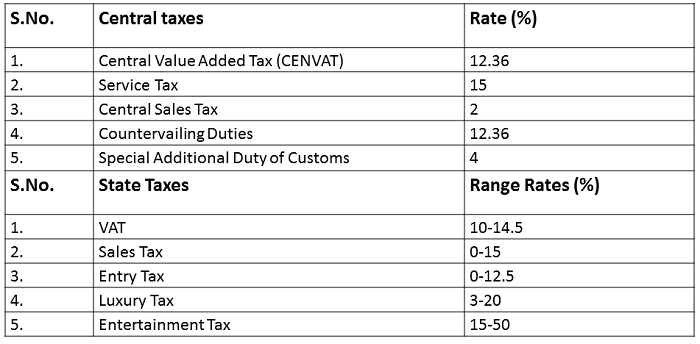

Gst A New Era In Indian Taxation Vivekananda International Foundation

Understanding Withholding Tax Microsoft Dynamics 365 Enterprise Edition Financial Management Third Edition

Pdf Goods And Services Tax Gst Transition To Sales And Services Tax Sst Impact On The Welfare Of B40 And M40 Households In Malaysia

List Of Key Changes In The Gst Regime From January 1 2022

Gst And Service Tax On Secondment Of Employees Taxmann Blog

Sales Tax 101 For Canadian Businesses Part Two Xero Blog

Pdf Goods And Services Tax Gst Transition To Sales And Services Tax Sst Impact On The Welfare Of B40 And M40 Households In Malaysia